Describe How Tax Rates Are Set Under a Progressive Tax

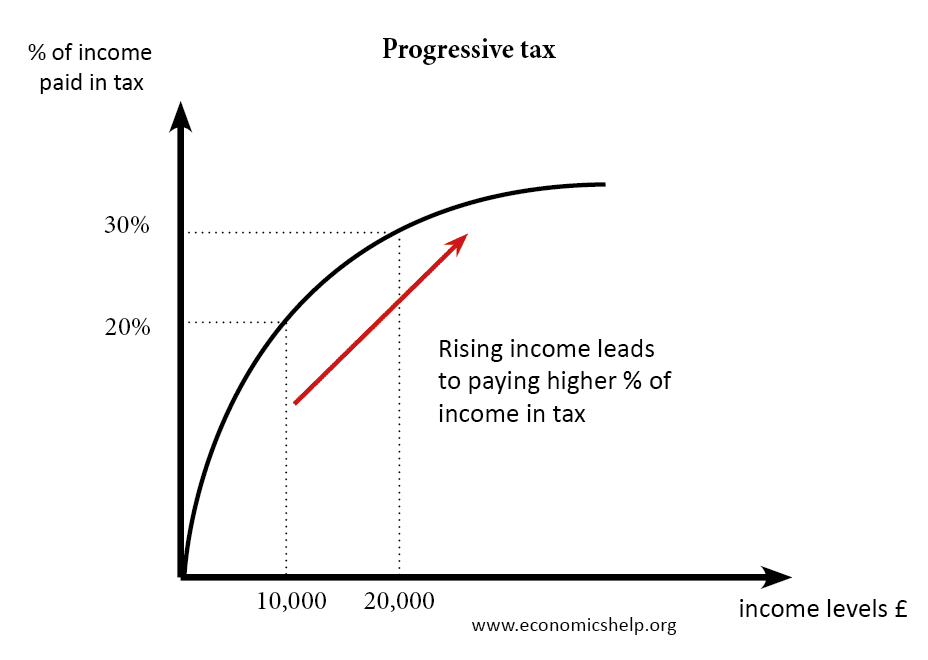

Tax line a represents a progressive tax rate tax line b represents a proportional tax rate tax line с shows a regressive tax rate and tax line d denotes a digressive tax rate. Progressive tax refers to the tax arrangement wherein the government imposes taxes with respect to the income levels of individuals.

Understanding Progressive Tax Rates Ag Decision Maker

If one tax code has a low rate of 10 and a high rate of 30 and another.

. Regressive Tax is a tax system in which the tax rate falls with the increase in the amount subject to tax. The 300000 family would pay 1548250 an effective tax rate just under 52 percent. In 2021 federal progressive tax rates are 10 12 22 24 32 35 and 37.

A progressive tax is a tax in which the tax rate increases as the taxable base amount increases. That would be the second-highest rate in the nation behind only. The term progressive refers to the way the tax rate progresses from low to high with the result that a taxpayers average tax rate is less than the persons marginal tax rate.

The proportional tax rate has a constant slope graphically while the. Federal taxes operate under a progressive system. 15hb Terms in this set 15 Progressive Tax A tax for which the percentage of income paid in taxes increases as income increases Taxable income income on which tax must be paid.

The first tax rate of 10 applies to. Income is taxed on the extra income earned eg. Those with estates over 1 million will.

So the higher someones income the higher the tax rate they pay. In a progressive tax system the percentage that someone pays in taxes increases as their income increases. Taxes are an important source of revenue for the government and progressive tax is one of the structures of the tax system it refers to that system in which as the income of the individual increases his or her tax liability will increase and vice versa.

Under Pritzkers plan the total corporate income tax rate would increase to 1049 799 corporate income tax plus 25 PPRT. As a result the higher-income group pays more tax than the lower-income group. A progressive tax is a tax whose rate _____ as the amount being taxed increases.

Secondly as progressive taxes are based on the ability to pay principle it tends to reduce disparities in the distribution of income and wealth. Estate taxes act as progressive taxes because individuals with larger estates incur larger tax bills. Applies its tax rate in marginal increments taxpayers end.

Progressive Taxes A progressive tax is simply one approach to determining who pays what amount in their taxes. The 16th amendment specifically allows for a federal income tax. Higher rate of income tax is charged at 40 on income above 36000 Example of Progressive tax Income tax threshold of 5000 means you dont pay any income tax on first 5000 Then marginal income is taxed at 25.

Note that that the higher-income family earning 10 times as much income pays 24 times as much state income tax. The degree to how progressive a tax structure is depends upon how much of the tax burden is transferred to higher incomes. Even with a lower rate the.

A progressive tax is a tax in which the tax rate increases as the taxable amount increases. Rich people are taxed at a higher rate than the poor because the ability to pay of the former increases as their incomes rise. The lower someones income the lower the tax rate they pay.

Progressive taxes make use of marginal tax rates. Describe how the role of the income tax in funding the government has changed since the Civil War. Progressive Tax Structure as base increases rate that applies on increase also increases Example of a progressive tax structure income tax Regressive Tax Structure as base increases rate declines Example of a regressive tax structure social security tax Social Security Tax rates 62 rate on the first 110100 of wages.

For instance an estate between 500000 and 750000 will be charged at a rate of 37. Lower-income filers pay less and higher-income filers pay more. Imposes a progressive tax rate on income meaning the greater the income the higher the percentage of tax levied.

A progressive tax system takes into account ability to pay setting rates based on income. Thirdly a progressive tax is productive as it yields more revenue. A progressive tax takes a larger share of income from high-income groups than from low-income groups which gives lower-income workers more money by letting them keep more of what they earn.

It isnt about initiating reform but rather an attempt to ensure taxation is fair to all payers. Income taxes were labeled unconstitutional. In progressive tax system the tax is imposed on income or profit on the basis of increasing rate schedule.

1 depicts the proportion of income taken away in taxation under different tax rates. There are seven tax brackets appliable in the United States which include 10 12 22 24 32 35 and 37. The United States has a progressive income tax system with seven different tax brackets ranging from 1037.

Total income minus exemptions and deductions Tax Return an annual report to the IRS summarizing total income deductions and the taxes withheld by employers Net Income. The progressive tax is a taxing mechanism wherein the tax rate rises with the rise in the taxable amount. Progressive Tax In the US.

The term progressive describes a distribution effect on income or expenditure referring to the way the rate progresses from low to high where the average tax rate is. That is as income or general wealth goes up so does the tax rate. Though income tax rates vary by location the result is the same.

List five of the non-tax sources of revenue used by the Federal Government.

Progressive Tax Definition System Rates Vs Regressive Tax

Comments

Post a Comment